As we watch the Easter-themed shelves in supermarkets swiftly replace the remnants of festive décor, it’s a stark reminder of how quickly the year progresses. Chocolate eggs and hot cross buns are not just heralds of an approaching Easter; they also signify that the financial year is advancing steadily. With just over three months until the curtains draw on the current fiscal period, it’s a critical time for you to plan and execute year-end financial strategies.

Over the coming months, my goal is to shed light on various End of Financial Year (EOFY) strategies you should consider. Today, we focus on a crucial aspect – understanding your superannuation contributions, an area often overlooked yet pivotal for long-term financial health.

Understanding Your Super Contributions

Superannuation is more than just a government-mandated retirement savings plan; it can be a significant tax planning tool and wealth accumulation strategy. However, to leverage superannuation effectively, one must be familiar with their contribution history, not only for the current year but also for the past five.

Why Review Past Contributions?

Looking back at your super contributions over a five-year period can reveal several opportunities, such as:

- Catch-up Contributions: If you have not reached your concessional contributions cap in the previous years, new ‘carry-forward’ rules allow you to catch up on any unused caps. This can significantly reduce your taxable income in the current year while boosting your retirement savings.

- Tax Planning: By examining your historical contribution patterns, you may find ways to optimize your contributions to benefit from tax concessions. Concessional contributions are taxed at 15%, which could be substantially lower than your marginal tax rate.

- Contribution Caps: Being aware of both concessional (before-tax) and non-concessional (after-tax) contribution caps is vital. Exceeding these caps can result in additional taxes or penalties, therefore tracking your contributions ensures compliance with the caps.

What are concessional contributions?

There are a number of ways you can contribute to superannuation. Depending on certain factors, contributions may be categorised as concessional or non-concessional. There are also other types of contributions that are not considered to be either concessional or non-concessional. Concessional contributions (CCs) commonly include:

- contributions made for you by your employer.

- salary sacrifice contributions, and

- personal contributions that you claim as a personal tax deduction.

CCs (within your cap – see below) are taxed at the concessional rate of up to 15% (or up to 30% if your income from certain sources exceeds $250,000) within your super fund. However, additional tax and penalties may apply for contributions made in excess of your cap. Non-concessional contributions include those made with after-tax money, such as your take home pay, or funds in your bank account. A different cap applies to non-concessional contributions.

Following last month’s release of the latest average wages data for the December 2023 quarter, the concessional and non-concessional contribution caps will increase on 1 July 2024 to $30,000 and $120,000 respectively.

What are catch-up contributions?

Caps apply to limit the contributions you can make to superannuation without having to pay additional tax and other penalties. The cap that applies depends on the type of contribution made. Contributions that are considered to be ‘concessional contributions’ count towards the annual CC cap. From 2018/19 to 2020/21, this annual cap was $25,000, which then increased to $27,500 in 2021/22 and remains unchanged in 2022/23 and 2023/24. If you don’t fully utilise your CC cap in an income year (from 2018/19 onwards), you’re able to ‘carry forward’ the unused cap amount, and you may be eligible to make ‘catch up’ concessional contributions in a subsequent year.

We generally use catchup contributions to offset Capital Gains tax liabilities, reduce your taxable income and boost your superannuation balance. I’ve attached a document that outlines how you are able to identify you unused CC. If you would like to understand how they may benefit you, please reach out.

The Essence of Quality in Investments

Defining Quality Beyond the Balance Sheet

At its core, choosing quality translates to selecting assets that are fundamentally strong, resilient, and able to weather economic storms. But there’s more to it than just financial indicators; quality investments also rest on the integrity and reputation of the companies or entities involved. Beyond the balance sheet, quality can be ascertained by the company’s market leadership, competitive advantages, corporate governance, and ethics.

Quality investments often stem from companies with a clear and defendable market niche, robust financial health, and a history of consistent returns to shareholders. It’s about companies that prioritize not just profitability, but also sustainability, which includes environmental and social factors. In other words, it’s a holistic assessment that goes beyond mere numbers and considers the broader impact and longevity of the investment.

Why Quality Trumps Quantity in the Long-Term

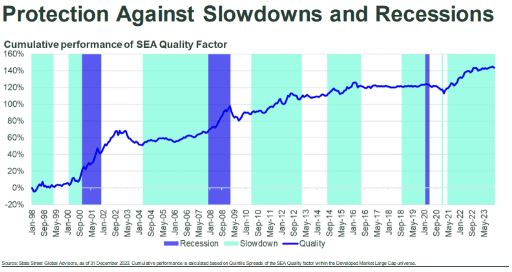

Quality investments have a compounding effect on returns over time. A business that continually reinvests in its core operations to maintain and grow its competitive edge tends to outperform in the long run. This is in stark contrast to companies seeking rapid expansion at the expense of solidity. The latter may offer higher short-term gains but often falter in the face of economic downturns.

By focusing on quality, investors not only protect their portfolios against volatility but position themselves to capitalise on growth more reliably. During downturns, quality assets provide a level of stability that can be hard to come by, minimising erosion in value when the market takes a hit.

Furthermore, quality investments are more likely to produce steady, compounding returns over the years. They may not offer the massive surges characteristic of some increasingly popular, volatile investments, but they also won’t lead to devastating losses when those high-risk strategies go south.

The Resilience of Quality Investments in Volatile Markets

The economic downturns of the past have served as a litmus test for investment quality. High-quality assets have consistently outperformed lower-grade or riskier investments in these conditions. This resilience comes from their ability to maintain operational strength, protect market share, and even capitalise on the misfortunes of their less-prepared competitors.

In contrast, quantity-focused or lower-quality investments can prove deadly in volatile markets. They often lead to over-exposure to risk and heavy reliance on the market performing according to historically high standards. When markets take an unexpected turn, these strategies suffer the most, sometimes with catastrophic consequences.

Integrating Quality into Your Investment Strategy

Adopting a strategy that values quality is not to forgo every high-risk opportunity, but rather to approach them cautiously and in proportion to a well-diversified, quality-driven portfolio. It involves active management, continuous reassessment of the investment landscape, and a forward-looking lens that anticipates opportunities for quality growth.

Carrying out due diligence, both from a financial and quality assurance perspective, when adding new assets to a portfolio. This means researching not only the historical performance and potential financial returns, but also the company’s business model, market position, and overall stability. Especially in today’s globalised economy, geopolitical and public-health risks have the potential to swiftly alter the investment environment, making a close examination of all quality factors critical.

How does this Work with Property Investing

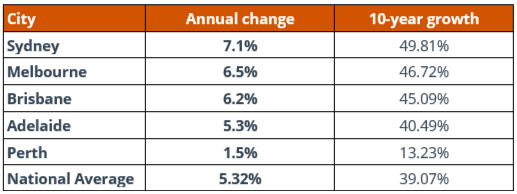

Turning our focus to Property Investments, the table below presents the latest insights on property growth over the last decade, a crucial metric for property investors to assess the performance of their assets against national averages.

The information highlights a trend in real estate performance across various cities up to March 2023. For property investors, understanding how your investment compares to these averages is vital. Underperforming assets may indicate that your capital could yield higher returns if allocated elsewhere. To provide a deeper insight, a website is available where you can input your suburb to check the expected rate of return over the past 10 years. Although the data is a year old, it remains an informative indicator of property performance trends. Access this valuable resource HERE.

Property investment should be approached with the same strategy as stock investing: focus on quality over quantity. Diligently seek out properties that have exceeded average growth values and understand the reasons behind their performance. Ensure you rely on solid facts to gauge potential growth.

The proximity to CBD areas doesn’t inherently promise above-average performance. Instead, look for the ‘Markets within the Markets’, akin to strategizing in the stock market.

Consider investment results from ‘blue chip’ suburbs in Brisbane, for instance. In West End, the value of houses has surged by 119.3% over the past decade, while units have seen a mere 14.1% growth. Furthermore, in Bardon, house prices have skyrocketed by 121.8%, compared to a 29.2% increase in unit prices. These figures suggest that, at least in these locales, houses have significantly outperformed the broader market, whereas units have not kept pace.

These case studies are just a snapshot of the wider picture but underline an essential element in property investment – comprehensive research and strategic selection are key to outperforming averages and making informed investment decisions.

Final Thoughts

The philosophy of quality over quantity may sound conservative or cautious, especially when compared to the allure of fast-growing markets or buzzy investment sectors. But for those with a clear-eyed view of their long-term financial objectives, the wisdom of this approach becomes apparent. Quality investments serve as a bulwark against market volatility, providing a solid foundation for wealth accumulation and financial security over the years.

While no investment strategy can eliminate risk entirely, a quality-focused approach can significantly reduce exposure to unnecessary risks and enhance the likelihood of consistent, favourable returns. In today’s economic climate, characterised by both immense opportunity and unprecedented uncertainty, it’s hard to overstate the importance of quality in shaping effective and reliable investment outcomes. For those interested in building a solid financial future, the path forward is clear: choose quality.

Beware the Smooth Talker

Quality is not only reserved for investing… surrounding yourself with quality advisers is fundamental in ensuring you have a strategy, and that strategy is designed to achieve your goals and is in the best interest for you. Ethics and professionalism have taken centre stage in our industry discussions, and I’ve been actively shaping these standards. I’ve been in this industry and providing advice for over 20 years, and my contributions into my profession range from advising regulators on educational and experience prerequisites for new Advisors to providing and delivering educational material to new to industry planners.

The archetype of the “smooth talker” is often regarded with suspicion, seen as a persona selling an elusive dream and leveraging flattery as a deceptive tool. A smooth talker typically presents grand visions and generalities to captivate and swiftly secure a deal, often leaving detail and substance behind. In contrast, today’s world, saturated with indirect sales tactics, seems to discount the value of clear, honest communication. As the vernacular of choice shifts towards more ambiguous speech, the rarity of straightforward dialogue is both alarming and refreshing.

The distinction between smooth talkers and straight talkers lies in the intent of their communication. Straight talkers prioritise the conveyance of ideas and principles, willing to tackle discussions head-on and explore topics in depth, even if it means engaging in sensitive or controversial topics. Their primary goal isn’t to schmooze but to communicate effectively and sincerely.

Consider this: straight talkers excel at having genuine conversations, regardless of the comfort level. They give you the unvarnished truth, even the details you may prefer to ignore, and they actively listen to the needs and feedback of their clients. In my two decades in this field, I’ve seen smooth talkers’ profit from inexperience and illusion. It’s disheartening to witness strategies that fail to consider individual client needs — what we call ‘cookie-cutter’ advice — become commonplace.

Recently, I’ve reviewed several formal complaint submissions that clients had lodged against their former adviser. These complaints unearthed a concerning pattern: the adviser had appeared to apply a one-size-fits-all strategy that also appeared to disregard personalised needs and the risk appetite of the client. Misplaced trust can lead to the smooth talker benefiting at the expense of the client.

Thankfully, the planner in question has received a banning order from the Australian Securities and Investments Commission (ASIC). These banning orders are not reached lightly and take years to finalise; ASIC employs rigorous investigation before such severe actions, ensuring only warranted cases are acted upon.

In sharing these insights through our newsletter, my intention is not to alarm but to reaffirm our commitment to transparency and integrity in service to you, our valued clients. Continuing on from the quality narrative, seek out quality in both who advises you, and what they advise you on.

Want to know more?

Thank you again for your trust in us and your loyalty, if you’d like to discuss any of the content in this update and how it may impact you, please call me on 07 3709 8485. If you know of anyone that you feel will benefit from meeting with us, please don’t hesitate to send them our details.