You may be eligible to make concessional contributions that are greater than the annual cap if you haven’t fully used your concessional cap in an earlier year. This could help you to save even more for retirement, while also managing tax.

What are concessional contributions?

There are a number of ways you can contribute to superannuation. Depending on certain factors, contributions may be categorised as concessional or non-concessional. There are also other types of contributions that are not considered to be either concessional or non-concessional. Concessional contributions (CCs) commonly include:

- contributions made for you by your employer

- salary sacrifice contributions, and

- personal contributions that you claim as a personal tax deduction.

US Election Dynamics and Investment Strategies

We must be vigilant about policy initiatives accelerated by the current US administration in anticipation of a tight election. The potential extension of export controls on China could signal critical shifts for multinational corporations and their investment strategies. The prospect of allies’ fragmented responses to these policies further underscores the necessity for agile and informed decision-making in investment circles.

CCs (within your cap – see below) are taxed at the concessional rate of up to 15% (or up to 30% if your income1from certain sources exceeds $250,000) within your super fund. However, additional tax and penalties may apply for contributions made in excess of your cap. Non-concessional contributions include those made with after-tax money, such as your take home pay, or funds in your bank account. A different cap applies to non-concessional contributions. See ato.gov.au

What are catch-up contributions?

Caps apply to limit the contributions you can make to superannuation without having to pay additional tax and other penalties. The cap that applies depends on the type of contribution made. Contributions that are considered to be ‘concessional contributions’ count towards the annual CC cap. From 2018/19 to 2020/21, this annual cap was $25,0002, which then increased to $27,500 in 2021/22 and remains unchanged in 2022/23 and 2023/24. If you don’t fully utilise your CC cap in an income year (from 2018/19 onwards), you’re able to ‘carry forward’ the unused cap amount, and you may be eligible to make ‘catch up’ concessional contributions in a subsequent year.

What eligibility rules apply?

To be eligible to make catch up CCs you need to:

- have a total ‘total super balance’3 at the 30 June prior less than $500,000, and

- be eligible to make super contributions. You are eligible if under age 67. If you’re 67 or older, you need to have met the work test in the financial year you’re making the contribution or be eligible for the work test exemption.

Remember that you can only carry forward unused CCs for 5 income years, after which they expire. For example, unused cap amounts that is not used by the end of 2023/24 will expire.

How to access carried forward CC details on MyGov

There are a few ways you can monitor your available carried forward CCs. This includes:

- keeping detailed records of all the contributions you and others (such as your employer) have made to your super accounts for the last 5 income years

- contacting your super funds to check what contributions have been received to your account in the past (including the accounts you may have closed), and

- checking your details on MyGov

On the following pages, the steps to using MyGov to access your carried forward CC information are explained. However, it is recommended that detailed records also be maintained, and that you refer to your own records rather than relying only on the information in MyGov. This is because there may be a delay before your super fund reports details about your contributions to the ATO. Remember, additional tax applies for excess contributions.

- Income for this purpose includes taxable income, reportable fringe benefits, total net investment losses and low tax contributions (concessional contributions that are within your concessional cap).

- Cap may be indexed in future years.

- Total super balance includes the total of all amounts you hold in super accumulation and pension accounts, in-transit rollovers, and if you have a self-managed super fund, it may also include the outstanding balance of a limited recourse borrowing arrangement. The total is reduced by personal injury or structured settlement contributions made to super.

How to monitor your carried forward concessional contributions

Steps Details

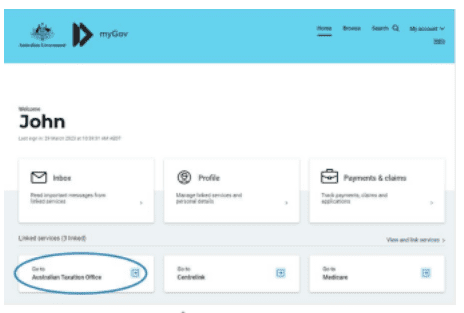

- Login to your MyGov account by visiting the following page my.gov.au and select the ATO service

- Don’t have a MyGov account or haven’t linked ATO?

-

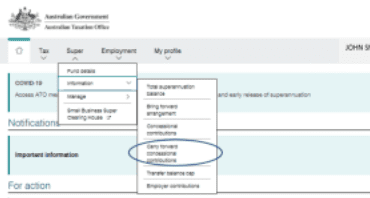

Select the ‘Super’ tab

-

Click the ‘Information’ option and then select ‘Carry forward concessional contributions’

If you don’t already have a MyGov account, you’ll need to set one up.

Link the ATO service to enable you to access information relating to your superannuation. For instructions on how to do this, please see: https://www.ato.gov.au/General/Online-services/Create-your-myGov-account and-link-it-to-the-ATO/

-

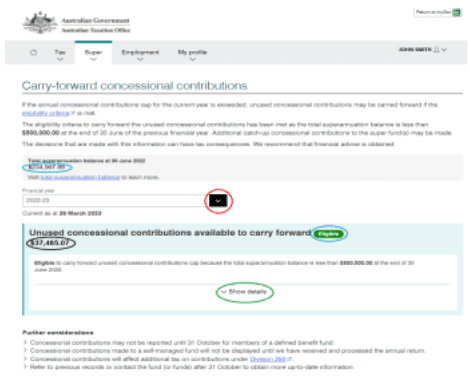

Use the arrow (red circled) to reveal a drop-down list to select a financial year. Your TSB as at the 30 June prior to the relevant financial year is displayed, and also whether or not you’re

eligible to make catch up CCs (blue circles). Your unused CCs available to carry forward is also displayed (black circle).

Click on ‘show details’ (green circled) to reveal how this figure was calculated in more detail (i.e. actual CCs and unused amounts for each financial year)

Information will be provided based on the data held by the ATO

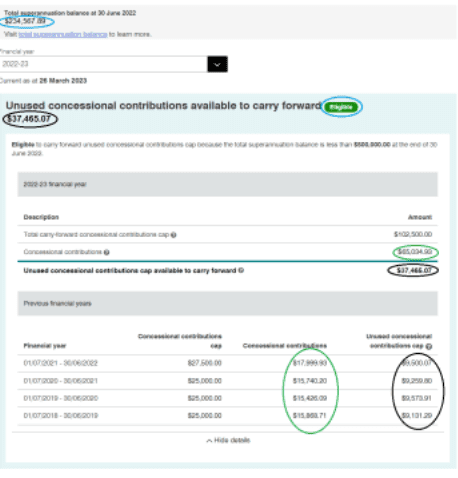

- After clicking on ‘show details’, data for the financial year, selected is displayed that shows total carried forward amounts available (black circled) and total CCs (green circled) reported, and also reported amounts from each financial year.

Note that this information is based on the data provided to the ATO by super funds for that financial year.

How to monitor your carried forward concessional contributions

Next steps

Contribution rules and eligibility criteria for catch up CCs are complex. This guide is not designed to provide comprehensive information about how the rules work or apply to you. It is important that you speak with us, your registered tax agent and visit the ato.gov.au for more information.