Unlock the Powerful Benefits of a Diversified Investment Portfolio with Matthew Tuton

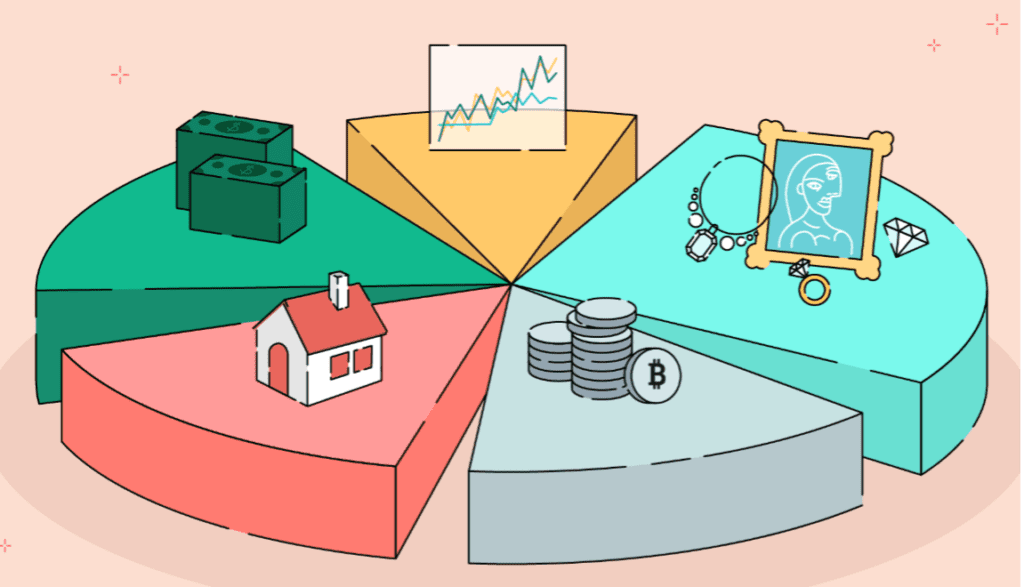

Discover the savvy strategy to protect and grow your wealth with a diversified investment portfolio. By combining property investments with shares, you can effectively minimize risks and increase your potential for returns.

Why is diversification so crucial? By investing in both property and shares, you’re not putting all your eggs in one basket. Instead, you’re spreading your investments across different asset classes, reducing the impact of any one investment’s performance on your overall portfolio.

But that’s not all. Investing in the stock market brings additional advantages. Unlike property, shares provide greater liquidity, allowing you to buy or sell quickly whenever you want. Say goodbye to the months-long process of selling a property.

When it comes to the sharemarket, the options are endless. Stocks, bonds, managed funds, and exchange-traded funds (ETFs) are at your fingertips. This variety empowers you to tailor your portfolio to match your individual risk tolerance and financial goals. Whether you’re eyeing high-growth tech companies or sustainable energy solutions, the sharemarket has something for everyone.

And let’s not forget about compounding returns. By reinvesting dividends, you can harness the power of compounding over time. This means potentially higher returns compared to solely investing in property.

Ready to take control of your financial future? Matthew Tuton, a seasoned investment advisor, is here to guide you. With over two decades of experience, he’s helped countless individuals and businesses navigate the complex world of investing.

Matthew offers a no-obligation appointment where he’ll take the time to understand your unique investment goals. From superannuation to wealth protection, he can assist with all aspects of your financial journey.

Don’t let the fear of overwhelming investment decisions hold you back. Matthew and his team make the process easy and straightforward. With their expert guidance, you can feel confident that your finances are in capable hands.

Need a Professional Opinion?

If you would like to seize this opportunity, please reach out as we can offer an obligation-free review of your situation.

To make an appointment, please call 07 3709 8485 or email admin@thesan.au.

Financial Planning advice is provided by Thesan Private Wealth Pty Ltd, ABN 54 661 639 247, Corporate Authorised Representative #425962 of TFS National Pty Ltd, Australian Financial Services Licence No. 532141. This document contains general advice and does not take account of your objectives, financial situation or needs. Before acting on this general advice, you should consider if it is appropriate for you. We recommend you obtain financial, legal and taxation advice before making any financial investment decision. Past performance is not a reliable indicator of future performance.