Contrary to popular belief, the notion that property prices double every 10 years is not entirely accurate. While it may have held true for several decades in the past, recent data suggests a more complex picture.

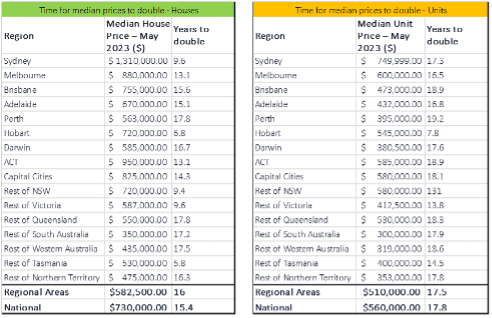

According to Cameron Kusher, the director of economic research at PropTrack, the national median house price currently stands at $730,000, and the median unit price is $560,000. However, it takes much longer than 10 years for these prices to double. In fact, it takes an average of 15.4 years for house prices to double and 17.8 years for unit prices to double.

Although this may appear discouraging, it’s important to note that certain markets have experienced rapid price increases. For instance, median house prices have doubled in a much shorter timeframe in some regions. Regional Tasmania saw a 100% increase in just 5.8 years, while Hobart followed closely at 6.8 years. Other areas, such as regional NSW, regional Victoria, and Sydney, also experienced median value doubling in less than a decade.

On the other hand, certain markets have seen slower growth. Perth, regional Queensland, and regional Western Australia have taken the longest time for house prices to double, ranging from 17.5 to 17.8 years.

When it comes to units, the story is slightly different. Hobart is the only market that has recorded doubling prices within the 10-year mark. In regional NSW and regional Victoria, unit prices took around 13.1 and 13.8 years to double, respectively. However, Perth, Brisbane, and Canberra have seen the slowest growth in unit prices, with doubling times exceeding 18 years.

Looking ahead, it’s essential to manage expectations. While the past decade saw irregular price increases influenced by the COVID-19 pandemic, it is unlikely that properties will return to doubling every 10 years. Factors such as higher interest rates, borrowing capacity constraints, growing household incomes, and migration have played significant roles in impacting price growth. However, these factors may not have the same impact in the coming years.

As I’ve previously stated, migration levels are expected to remain strong, but interest rates are unlikely to fall with any materiality, employment participation may not increase significantly, and accessing mortgages may become more challenging. As a result, the days of property prices doubling every seven to 10 years may be a thing of the past.

To Summarise

Stay connected with us and don’t wait for your annual review to reach out. We’re here for you if anything in your life changes and affects your financial goals. Don’t assume that the same strategies from 5-10 years ago still apply today. Whether it’s a positive or negative change, it’s equally important to let us know. Take a moment to think about your abilities and you might be surprised by what you can achieve. If you need help with that, we’re more than happy to assist you.

And remember, when investing, keep your eyes wide open, focus on quality assets, diversify your investments, review your interest rates, understand your cash flow and budget, and regularly assess your strategy.

Want to know more?

If you’d like to discuss any of the content in this newsletter and how it may impact to you, please call:

Matthew Tuton

P: 07 3709 8485

Director of Financial Services

MBA, GradDip FP, FIML, SA FIN, AFP®. ASIC# 275713

Need a Professional Opinion?

If you would like to seize this opportunity, please reach out as we can offer an obligation-free review of your situation.

To make an appointment, please call 07 3709 8485 or email admin@thesan.au.

Financial Planning advice is provided by Thesan Private Wealth Pty Ltd, ABN 54 661 639 247, Corporate Authorised Representative #425962 of TFS National Pty Ltd, Australian Financial Services Licence No. 532141. This document contains general advice and does not take account of your objectives, financial situation or needs. Before acting on this general advice, you should consider if it is appropriate for you. We recommend you obtain financial, legal and taxation advice before making any financial investment decision. Past performance is not a reliable indicator of future performance.