Welcome to our June newsletter! As we navigate the ever-evolving financial landscape, it’s crucial to stay informed and vigilant. This month, we’re bringing you the latest market insights and trends, as well as awareness on financial scams that you should be wary of around tax time.

As always, I am transparent and open to any question that you may have, and my goal is to empower you with the knowledge for you to feel comfortable and informed about your investments. Thank you for trusting us with your financial journey. Let’s dive in!

Monthly Update

Welcome to the latest edition of our Market Update!

Australian Market Highlights

Economic & Interest Rates Update

The Australian economy hasn’t shown much growth over the past 12 months with the economy only rising 0.1% QoQ and 1.1% annualised in seasonally adjusted chain volume measures. Australian inflation is still above international economies, we are therefore unlikely to see any rate cuts in the short term. Currently, the market does not believe we will have a rate cut this year, so we should not look forward to any change in interest rates from the RBA for the remainder of 2024, as now all the talk around this is very much the opposite… that being the potential for an interest rate increase.

For the record, although this is the case, we are not expecting rates to increase this year as this would certainly drive the economy into a technical recession… something that the government won’t want in an election year.

Equity Markets

The ASX 200 has only really performed over the past 6 months, as if we take that away, the market has been flat for almost 18 months as the uncertainty with interest rates and little to no economic growth amongst other things have been the driving factors to the lacklustre share market performance we’ve seen to date.

Australian Property Markets

Last week was quieter than usual for auctions, likely due to the King’s Birthday long weekend in most states. Only 1,281 auctions were held, a significant drop from 2,380 the previous week, marking the lowest auction volume since Easter (when there were 901 auctions).

The preliminary clearance rate fell to 67.3% across the combined capital cities, the lowest so far this year and the first time it has dipped below 70% since late last year. The previous week’s preliminary clearance rate was 71.4%, which was later revised down to 66.2%. In terms of auction volume, Brisbane led the market with 125 homes going under the hammer, down from 141 the previous week. Adelaide saw 97 auctions, down from 152 the week before, and the ACT held 67 auctions, roughly the same as the previous week’s 68. Perth had 15 auctions, and Tasmania had just one.

Adelaide continues to stand out with a very high clearance rate of 85%, based on initial records. Brisbane’s early clearance rate increased from 64% to 67%, while the ACT saw its lowest rate this year at 52.4%. Auction volumes are expected to rebound this week with around 2,300 homes scheduled for auction, although this will drop to approximately 2,100 next week.

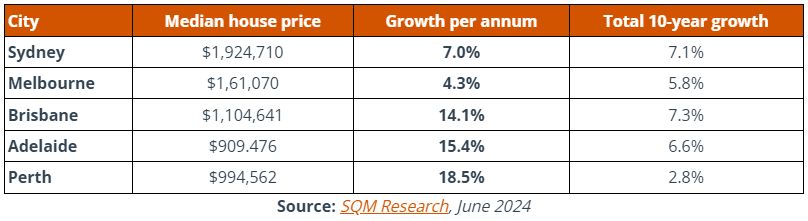

Property prices in the combined capital cities have grown by 11.96% annually, which is above the 10-year average of 5.92%. Perth, in particular, has seen a significant surge with a 18.5% growth over the past 12 months with Melbourne not even achieving the 10-year average… so it pays to do your research!

International Share Market Highlights

United States

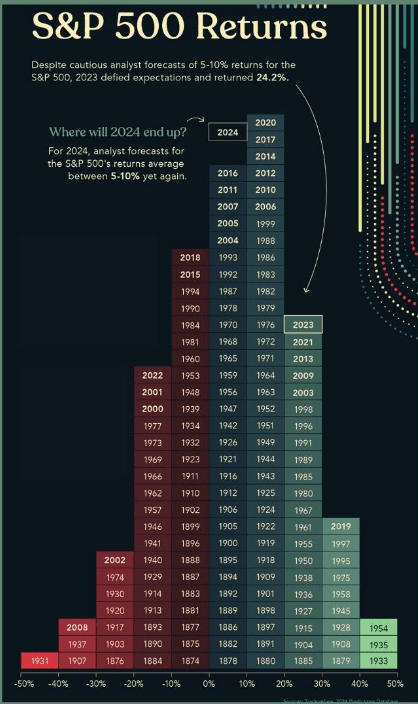

The U.S. economy continues to recover strongly. The S&P 500 has continued to reach new highs, closing the month up by 2.38% and a 12 month return of 23.23%. This bullish trend is supported by strong corporate earnings and positive employment data, with the unemployment rate little changed at 4%. I do expect the volatility to continue but I would not be surprised to witness a selloff in the market through the September/October period before witnessing a year-end rally. I still expect the S&P500 to be higher on the year as the US elections passes and interest rates see declines. US CPI numbers come out tomorrow and softer data will increase the probability of rate cuts. This will naturally be good for risk assets such as stocks/bonds. The Fed rate decision will follow on Thursday, although I do not expect a rate cut there at this stage.

Europe

European markets are experiencing mixed results and low economic growth. While the 1-year DAX result in Germany is up by almost 15%, other markets like the FTSE 100 in the UK are showing slower growth at around 8.5% (similar to the ASX 200). The ongoing energy crisis and supply chain disruptions are key factors affecting these markets, as such, we have limited exposure in this region with your investments.

Asia

Asian markets are showing signs of recovery, particularly in Japan where the Nikkei 225 returned a 12-month result of over 20%. South Korea’s KOSPI index have experienced slight gains along with China. The easing of Covid-19 restrictions and increased vaccination rates are contributing to this positive momentum.

Insights

Market Sentiment

We believe that the current market sentiment is cautiously optimistic for the remainder of 2024. While there are several headwinds, including inflation concerns and geopolitical tensions, the overall outlook remains positive due to strong economic fundamentals and corporate performance. Given the current market conditions, we have been interested in high-growth tech stocks and stable blue-chip companies in the healthcare sector.

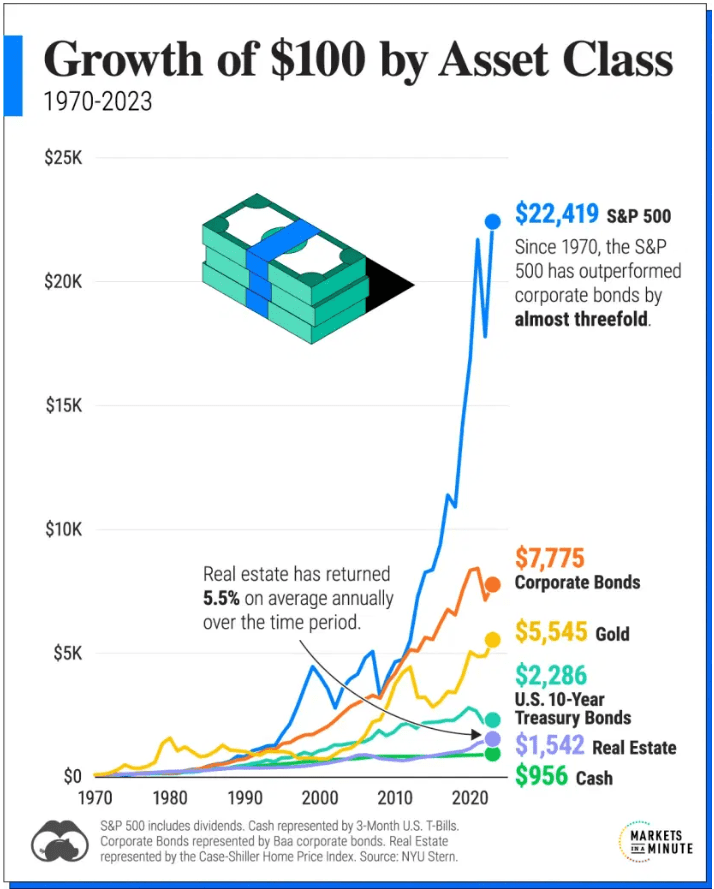

One last thought… Investing a small amount goes a long way –

Australians Lost Over $2.7 Billion to Scams Last Year

2023 was a costly year for many Australians, with scam reports rising by over 18%, totalling more than 600,000 incidents. The financial impact was equally staggering, with over $2.7 billion lost to fraudsters. As we move through 2024, scams continue to pose a significant threat, making it essential to stay informed and vigilant.

Scammers prey on our sense of trust, legitimate concerns, insecurities, and curiosity. The key to resisting them is to stop and think critically about the validity of an offer or solicitation. For example, if substantial and low-risk returns were truly possible, why wouldn’t a reputable financial institution offer them?

Scams have evolved over the years, but the keys to protecting yourself remain the same: be sceptical, deal only with trusted individuals, conduct thorough due diligence, and educate yourself about your investments and options. Here are our top four tips for safeguarding your wealth:

1. If it seems too good to be true, it probably is

Investment opportunities that promise fast results and returns well above market rates are often high-risk scams. Scammers frequently capitalise on popular trends or asset classes—such as cryptocurrency—to make their offers seem appealing and legitimate.

Once your money is gone, recovering it can be incredibly challenging. Some people may be tempted to take a high-risk approach, believing their bank can recover their money if an opportunity turns out to be a scam. However, if you’ve been scammed—if you’ve handed over money or given strangers access to your accounts—your chances of getting your money back are slim.

2. Invest with professionals you know, not strangers

If you have funds to invest, consider using a licensed financial adviser (us) and always engage with people or institutions you trust. Scammers are adept at being charming and knowledgeable, often showing understanding and empathy to gain your trust.

Ask yourself: if a stranger knocked on your front door asking for a substantial deposit, promising to return it with interest in 10 days, would you contemplate it? This offer should immediately raise red flags as suspicious and dangerous. When you respond to an unsolicited offer and hand over money or access to your financial and personal details, you’re essentially inviting that stranger into your financial life, putting yourself at high risk of financial loss.

3. Do independent research and due diligence

When an opportunity catches your interest, ensure that your research is independent and sourced from reputable and trusted sources. Government websites like the Australian Competition and Consumer Commission (ACCC) and the Australian Securities and Investment Commission (ASIC) often provide information on current scams.

Using credible and publicly available information is a crucial way to verify the legitimacy of the person and business contacting you. Be mindful that scammers can go to great lengths to appear legitimate, including using the name and job title of an actual employee at a known institution.

The critical part of this process is to obtain these details independently. For example, if you receive a cold call, take the caller’s name and then find the business phone number from an independent source to verify the information. Do not rely on the contact details provided by the individual on the phone.

In short, don’t assume the information you’re given is legitimate. Cross-check from sources unconnected to the offer. Better still, consult your financial adviser.

4. Don’t rely on someone else to protect you

Banks and financial institutions have sophisticated systems designed to protect against fraud and other types of interference with your accounts. However, you should never assume that technology will protect you at all times. Scammers know the easiest way to access an account is through the person who holds it. This puts the onus on customers to treat any offers with a healthy dose of scepticism.

The good news is that there are many resources and steps you can take to protect yourself. Respect your funds and the effort it took to accumulate them. Be cautious, do your homework, call on experts, and never respond to time pressures or threats.

After all, it’s your money—and you want to keep it that way.

Key Takeaways

• Your chances of recovering money lost to a scam are low. Prevention is better than cure, and being informed about how to protect yourself is crucial.

• Don’t assume your device or its software will protect you. Scammers target individuals because they are easier to persuade than bypassing sophisticated bank systems.

• When dealing with finances, only engage with verified professionals and institutions. Taking a risk on a stranger can cost you significantly more than the potential return.

• Stay informed and stay safe!

What to Do If You’ve Been Scammed

Think you might have been scammed? These steps will help you take swift action to minimise the damage. Remember, you’re not alone, and recovery is possible. Support is available whenever you need it.

Act Fast If You’ve Been Scammed

If you suspect you’ve fallen victim to a scam, follow these immediate steps to mitigate further impact:

- Stop Sending Money: Cease all financial transactions with the scammer. Block all contact from them.

- Contact Your Bank: Report the scam to your bank or financial institution immediately and ask them to halt any pending transactions.

- Alert Family and Friends: Inform your close network about the scam so they can avoid falling into the same trap.

If You’ve Paid a Scammer

Depending on how you made the payment, here’s what you should do next:

- Credit or Debit Card: Contact your bank or card provider right away to report the scam and stop any transactions.

- Gift Card: Notify the company that issued the card.

- Wire Transfer: Report the scam to the wire transfer service or bank.

- Money Transfer App: Inform the app’s provider (not the app store) about the scam.

- Cryptocurrency: Report the scam to the platform or company you used for the transaction.

- Cash: If you sent money through mail or a delivery service, contact Australia Post or the relevant delivery service to attempt to intercept the package.

- Unauthorised Transfer: If money has been transferred without your consent, report it to your bank immediately and request to freeze your accounts and transactions.

If a Scammer Has Your Personal Information

If your personal details (such as name, phone number, email, address, or identity documents) have been leaked in a data breach, take these actions:

1. Report to Financial Institutions: Inform your bank, super fund, and any other financial services.

2. Contact IDCARE: Call 1800 595 160 (Monday to Friday, 8am–5pm) for a free plan to limit the damage.

3. Update Passwords: Create new, strong passwords that you haven’t used before. Update any accounts that used the compromised password.

4. Monitor Suspicious Contact: Be vigilant for suspicious emails, calls, texts, or social media messages. Block or ignore unknown contacts and avoid clicking on any links.

5. Check Bank Accounts: Regularly monitor your bank accounts for unauthorised transactions.

6. Monitor Credit Report: Request a temporary ban on your credit report to prevent unauthorised loans or credit applications.

If a Scammer Has Accessed Your Computer or Phone

If a scammer has accessed your device by pretending to be from your internet or phone provider, here’s what to do:

- Computer Access: Update your security software and run a virus scan. Delete any identified threats and reset your passwords.

- Phone Access: Report the incident to your phone provider. Update security software, run a virus scan, change your passwords or PINs, block scam calls, and consider changing your phone number.

You may also want to seek help from an IT professional to check your devices.

If you need further assistance, call the Australian Cyber Security Hotline at 1300 292 371 (available 24/7) for expert advice and support.

Watch Out for Follow-Up Scams

If you’ve been scammed, be wary of follow-up scams that may try to exploit you further. Hang up or block communication if someone:

- Offers to swap your investment to recover your losses.

- Tells you to ‘hang in there’ as your investment will soon increase.

- Offers to buy your shares at a premium but asks you to pay a fee.

- Asks for a fee for a fake share certificate.

- Claims they can recover your losses for a fee or a percentage of recovered losses.

- Asks for travel and accommodation costs to find the scammer.

These are tactics scammers use to extract more money from you.

Report the Scam

Reporting scams helps authorities build cases against scammers and warns the public. By reporting, you can help prevent others from becoming victims.

Get Support After Being Scammed

If a scam has resulted in financial difficulties, consult a financial counsellor. This free and confidential service can help you get back on track.

Being scammed can be emotionally taxing. If you need someone to talk to, contact:

- Lifeline: 13 11 14 or use the online Crisis Support Chat

- Beyond Blue: 1300 22 4636 or visit the Beyond Blue website

Taking these steps can help you regain control and start the recovery process. Remember, support is always available.

Stay Connected

Please follow us on LinkedIn and Facebook by clicking on the below links.

Want to know more?

Thank you again for your trust in us and your loyalty, if you’d like to discuss any of the content in this update and how it may impact you, please call me on 07 3709 8485. If you know of anyone that you feel will benefit from meeting with us, please don’t hesitate to send them our details.