We are excited to welcome you to a new financial year! In this month’s update, I’ll cover off a number of significant changes that took effect on July 1st and provide some market predictions for the upcoming year.

Last year was extraordinary for our clients, with many experiencing exceptional market returns. Some accounts saw growth as high as 30%, with most averaging in the high teens—a performance we haven’t seen in quite some time and I’m proud to say, well above average Industry superannuation fund results.

What Changed on the 1st July?

Stage Three Tax Cuts

Starting today, all Australian workers will benefit from tax cuts ranging from $350 to $4500, depending on their income bracket, as Labor’s stage three tax cuts take effect.

For Low And Middle-Income Earners:

- The lowest tax rate for those earning between $18,201 and $45,000 will drop from 19% to 16%.

- The 32.5% tax rate for those earning above $45,000 will fall to 30%, now capping at $135,000.

For High-Income Earners:

- Those earning between $135,000 and $190,000 will now pay 37% tax, up from the previous threshold of $120,000.

- The top tax bracket of 45% will kick in at $190,000 instead of $180,000.

The revised tax cuts aim to provide additional relief to low- and middle-income earners while reducing benefits for those earning over $150,000. The changes ensure all 13.6 million taxpayers receive a cut, with 2.9 million more people benefiting compared to the original plan. The average taxpayer is set to save $1888 per year.

Although this may come at a much-needed time, Economists are divided on the potential inflationary effects of these cuts given the latest inflation figures we was last week. My suggestion (and not formal advice) would be to add any extra cash you receive to your non-deductable debts as the first priority.

$300 Energy Rebate for All Households

From July 1, all households will receive a $300 rebate on their power bills, broken down into four $75 quarterly credits. Small businesses will also benefit from a $325 rebate, and this is on top of any state based rebates that have been announced. I was able to save almost $1,000 off my annual energy bill by comparing and changing providers.

This initiative aims to mitigate rising energy costs and inflation, potentially saving households amounts over the financial year. While some experts argue that such rebates may contribute to inflation, I’m of the opinion that it’s so immaterial that it will have little to no impact on inflation figures.

Increased Support for Small Businesses

Small businesses are the backbone of the Australian economy, and the government is introducing new measures to support them. Starting this financial year, small businesses will have access to a range of new grants and subsidies aimed at fostering growth, innovation, and competitiveness.

New Initiatives:

- Innovation Grants: Funding available for small businesses to invest in new technologies and innovative practices.

- Training Subsidies: Financial support to upskill employees with the latest industry-specific knowledge.

- Export Assistance: Grants to help small businesses enter and expand into international markets.

These initiatives are designed to create a more resilient and dynamic small business sector, driving economic growth and job creation across the country.

Expansion of Paid Parental Leave

Australia’s paid parental leave scheme will expand from 20 to 26 weeks by 2026, with two-week annual increments starting July 1. The pay rate remains tied to the national minimum wage, increasing to $915.91 per week.

Parents who had or adopted a child after July 2023 can access the expanded leave scheme. Eligibility criteria include:

- Combined income less than $350,000 for both parents.

- Majority of leave provided to one parent earning less than $168,865 if combined income exceeds the threshold.

- Single parents earning less than $350,000 qualify for full leave payments.

The increased leave aims to provide families with more time to bond with their newborns and adapt to the significant life changes that come with new parenthood; something Mat White will experience shortly with his 2nd child due any moment now, and something I only experience a couple of years ago with my third child, time that you miss and can bever get back again! I personally think this is one of the better introductions, as I’m a firm believer of spending time with your young ones where possible.

Welfare Payments Indexation

Effective July 1, payments to over two million Australians will increase due to the latest quarterly round of indexation to income and asset thresholds. Changes will impact Family Tax Benefit, Multiple Birth Allowance, Newborn Supplement, Stillborn Baby Payment, and Essential Medical Equipment Payments.

These increases will also benefit nearly one million Age Pension, Disability Support Pension, and Carer Payment recipients through higher income and asset thresholds.

Superannuation Guarantee Increase

Starting July 1, the superannuation guarantee increases by 0.5% to 11.5%, and it will further rise to 12% by July 1, 2025. This change ensures that employers set aside a larger portion of wages for employees’ retirement.

Superannuation Contribution Caps

From July 1, superannuation contribution caps will also increase. The before-tax contribution cap for 2024-25 will be $30,000, up from $27,500 in 2023-24. The after-tax contribution cap will rise to $120,000 from $110,000.

With these increased superannuation caps, it’s important to keep a track of any unused (catch up) contributions, as taking advantage of these could greatly increase your superannuation balance upon retirement.

Market Predictions

As we Australians kick off the new financial year, I thought I’d reflect on the one just passed as well as again attempt to look forward into the future to give investors an idea of what to expect.

Financial Year 2024

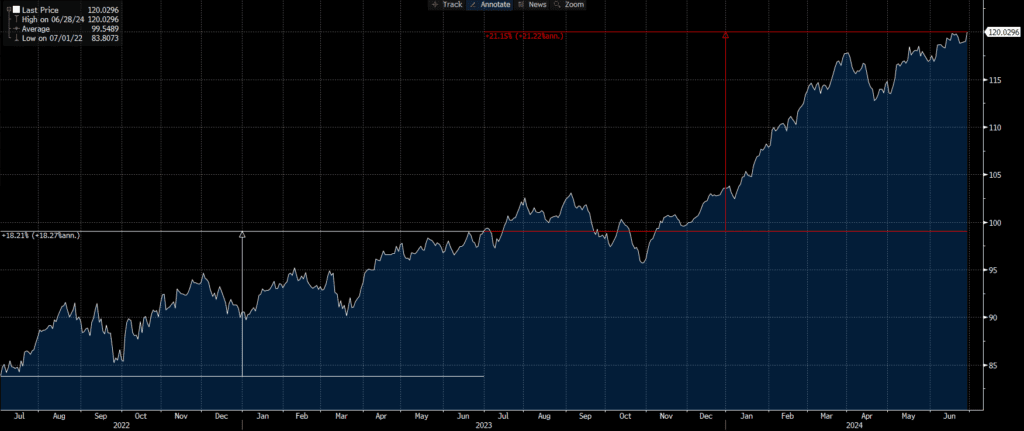

It’s been another good year for our investors – this includes wholesale clients that hold individual managed accounts, retail clients invested in the SMA, property investors, and those that hold a combination of all investment options available to them. The SMA had almost an identical year in FY24 as it did in FY23 – up around 20% (see graph below). The reason for the consistently good returns is simple – US markets have beaten all other markets including Australia.

The ASX200 finished up 12% on a total return basis as opposed to the S&P500 which managed to finish our financial year up 24.5%. US large cap were strongly favoured by investors as the rally witnessed since Oct 2023 saw only a brief pullback in April 2024 before rallying through May and June.

Interest rates have softened substantially which gave investors comfort in adding more equities (especially large cap AI focused shares) to reinforce portfolios ahead of Fed cuts. For Australians however the interest rate future is more uncertain….

Financial Year 2025 – Looking ahead

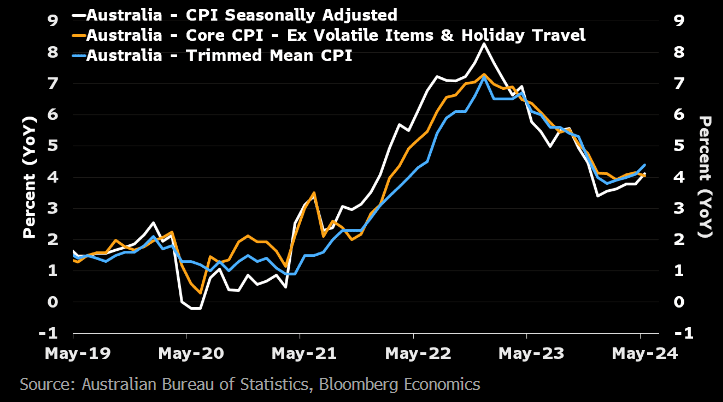

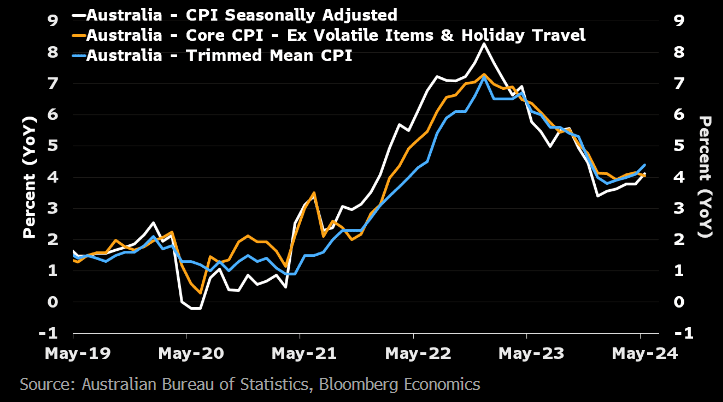

Australia has not beaten inflation. Currently the market is not yet forecasting interest rate rises, but the odds have changed dramatically since Jan 2024. Accordingly, I’ll make 5 predictions for the year ahead that i’ll revisit over the year.

Prediction 1 – Australians will learn the word ‘stagflation’.

We’ve all heard the word ‘inflation’ with the cost-of-living crisis that the media talks about. What is worse than inflation though is stagflation. This is the unwelcome phenomenon of higher inflation and slower growth (and higher unemployment).

Our inflation rate is outside the RBA’s target rate of 2-3% and our growth rate is at ~1% pa and falling. The US central bank has beaten inflation so US markets will start to get more concerned about growth than inflation. They’ve got plenty of room to cut rates, however as US rates hover around 5.35%, a full 1% above ours. The RBA has NOT beaten inflation and our growth is sluggish so we can’t cut rates to stimulate economic growth until inflation is under control.

Worse still, the RBA may be forced to raise rates if the CPI print does not show signs of declining in the months ahead. We do seem to be stuck at the current 4% YOY level as the graph below shows. We are also trending higher so I have to predict – if there is not a cool inflation print in the next month or so, the next rate move will be…..up.

Prediction 2 – Australia will continue to underperform

The past underperformance of Australia relative to the US will continue. The US is hitting all the big global thematics of AI, pharmaceutical advancements, re-industrialisation and energy transformation. The rest of the world can’t keep up. This will be a long-term trend that will continue as the world de-globalises and wealth bifurcates.

Australia is a small open economy that has grown rich from globalised trade. Those years are now in the past and Australia at a broad level will find it tougher to compete in its traditional export markets of iron ore, coal and natural gas as South America and Africa have grown in extraction efficiency and competitiveness.

Prediction 3 – The market will trade off through September and October but end the calendar year higher.

I expect a relatively solid winter as US markets consolidate or move higher. I do think the historically worst month of September will show itself given it is an election year in the US. As a result, I think the market will fall quite substantially in September and into October. This could be an opportunity to invest any cash you may have, as I think the market will rally into year’s end once the election has resolved itself. On the subject of the election….

Prediction 4 – Trump will win.

It’s no secret that Biden did not perform well in the recent debate. Quite frankly, I’d be very surprised to see him front up to a 2nd debate. I’m less sure about him stepping aside though. It’s a tall ask to get a new candidate so close to the Democratic Convention given how much money has to be raised. It isn’t impossible though and was done in 1968. It becomes harder though if Biden wants to seek re-election as 1968 was easier when LBJ decided to not seek the nomination.

Whatever occurs, Trump was hitting the right notes with the electorate, and I can see him repeating the same themes all the way up to the election. Immigration, tax cuts and tariffs will be talked about every day until November. The implications for Australia will be big – expect a wind-back in the Inflation Reduction Act, tariffs, and a push to withdraw US military security over nations that don’t spend money on defence.

Prediction 5 – US rate cuts will ensure the market rally will broaden away from just tech.

The US central bank does not want to appear to be political, and so will be reluctant to cut rates in September. There probably isn’t enough evidence that inflation has fallen just yet, but if numbers are sufficiently cool, I believe that the Fed would rather cut in July than September. Either way, I expect a November rate cut and I think portfolios need to be diverse enough across industrials and financials given I think the market rally will broaden away from just tech companies through November/December and into 2025.

To Summarise

With those predictions I think investors should expect portfolios to remain largely the same – overweight US large cap and underweight Australia. I do not expect 20% gains for FY2025, but I would expect muted (but still respectable) 10-15% returns if the rally matures and broadens. I remain optimistic about Japan and more cautious with regard to China.

Stay Connected

Please follow us on LinkedIn and Facebook by clicking on the below links.

Please take the time to review us on Google by clicking on the link below –

Thank you again for your trust in us and your loyalty, if you’d like to discuss any of the content in this update and how it may impact you, please call me on 07 3709 8485. If you know of anyone that you feel will benefit from meeting with us, please don’t hesitate to send them our details.