Welcome to the Spring edition of the Thesan Private Wealth update. Who would have thought that there are only a little over 100 days until Christmas!!!

In this month’s update, we’ll keep it local by reviewing and summarising the notes of the latest Reserve Bank meeting, as these notes provide us a great insight into the governors thinking and what’s install for the economy over the coming months. I’ll provide an update on how the share market faired during last month, and I’ll finish off by revisiting an education section and explain ‘What is an ETF’, as many clients ask about them, and it’s good to understand what they are, and why we use them in your portfolio.

RBA’s Economic Insights and Future Trends

Summary

Global Growth Outlook

- Major Trading Partners (MTP) Growth: Anticipated to be moderate with a forecast of around 3¼% over 2024 and 2025.

- Inflation in Advanced Economies: Expected to ease, though the timing of reaching target levels varies across different economies.

Country-Specific Highlights

- G7 Economies and China: Slightly weaker forecasts for 2024 compared to three months ago. However, high-income East Asia shows an upward revision.

- Australian GDP Growth: Projected to be stronger than previously forecast, driven by public demand.

Labor Market and Inflation

- Australian Labor Market: Expected to ease but remain tight. Unemployment rates might rise gradually.

- Inflation: Underlying inflation to return to target slightly later, expected inside the 2–3% range by late 2025, meaning interest rates will stay higher for longer.

Opportunities and Challenges

Opportunities

- Public Demand in Australia: Strong public demand driving GDP growth offers a potential area for investment.

- High-Income East Asia: Better-than-expected growth in this region could present new investment opportunities.

Challenges

- Chinese Growth Risks: Weak property sector sentiment and local government financial strains pose downside risks.

- Persistent Inflation Components: Continue to monitor sectors with persistent inflation as they may affect the pace of disinflation.

The RBA’s Key Domestic Judgements

Overview

Their central forecasts integrate various judgements, including model choices and deviations based on recent data or qualitative inputs. Extensive discussions shape these forecasts, focusing on three critical judgements that influence their current economic outlook.

Judgement #1 – Higher Excess Demand in Economy and Labor Market

Recent assessments indicate more excess demand in the economy and labour market than previously thought. This is crucial for forecasting wages and prices. Their models suggest that full employment is lower than earlier estimates. Despite some positive changes in the labour market, such as reduced long-term unemployment and flexible work arrangements, the evidence of their long-term impact is mixed.

Inflation and wage growth have surpassed previous estimates, indicating the economy is further from potential output and full employment. This imbalance implies a longer path to target inflation. However, significant uncertainty remains.

Judgement #2 – Turning Point in Household Consumption

They anticipate household consumption will rise from the second half of 2024, following an 18-month decline. This judgement is based on recent upward revisions in the March quarter National Accounts. These revisions align with historical trends in income and wealth, showing households are willing to save less.

Real household income and wealth are expected to grow strongly over the forecast period. Notably, real disposable income will increase from mid-2024 due to Stage 3 tax cuts and lower inflation. The outlook for consumption is uncertain.

Judgement #3 – Gradual Easing of the Labor Market

They expect the labour market to ease gradually and stabilise with GDP growth. The unemployment rate will likely rise over the next year, similar to past downturns. Adjustments in labour demand may occur through reduced vacancies and average hours worked, rather than layoffs. Indicators like job vacancies remain high, and firms’ hiring intentions are only slightly below average. Although there’s a possibility of rapid unemployment increases if businesses reach a tipping point, current data shows no strong evidence of this as of yet. Capacity utilisation remains above average, and vacancies and hours worked are at long-run trends.

Economic Outlook & Key Risks

Overview

As we look ahead, it’s crucial to understand the potential risks and opportunities in the current economic landscape. We will analyse the key risks to the outlook for economic activity and inflation.

Balanced Risks with Varied Costs

The risks to domestic activity and inflation are currently balanced, but the costs associated with these risks vary significantly.

Persistent Inflation:

If inflation remains above target, it could significantly impact economic welfare, especially for lower-income households. Sustained high inflation may raise expectations, leading to more monetary tightening and potentially higher unemployment to reset these expectations.

Weaker Economy:

A downturn could return inflation to target faster but would likely come at the cost of employment, with long-term adverse effects on the labour market.

Key Risks to Monitor

1. Excess Demand in the Economy

There is a possibility that the economy and labour market have more excess demand than currently assessed. This could stall disinflation progress, resulting in a tighter labour market and increased inflationary pressure.

Scenarios:

- High Estimates: Current estimates might overstate labour market capacity, indicating a need for further inflation control measures.

- Transitory Factors: Alternatively, recent high wage growth and inflation could be temporary, influenced by supply disruptions and structural changes in the labour market.

2. Persistent or Recovering Consumption Growth

Household consumption growth poses another significant risk. The outcomes can materially affect unemployment and inflation.

Scenarios:

- Lower Consumption: If households save all income growth, GDP growth would slow, increasing unemployment but reducing inflation faster.

- Higher Consumption: If households spend more, unemployment could decrease, but inflation reduction would stall.

3. Labor Market Deterioration

The labour market might see a greater-than-expected rise in unemployment, though the increase is gradual.

Scenarios:

- Higher Unemployment: A sharper rise in unemployment could occur if firms have excess staff or if labour market adjustments have run their course, leading to faster inflation decline.

- Lower Unemployment: A stronger-than-expected labour market could delay inflation reduction as vacancies remain high and labour demand sustains.

August Market Recap and September Outlook

August saw significant volatility in the markets, with both the S&P 500 and ASX 200 dropping around 5% early in the month. The sell-off was intense, as indicated by the VIX (a volatility measure) reaching levels comparable to those seen during the Covid-19 pandemic and the Global Financial Crisis. However, the markets calmed relatively quickly, and by the end of the month, there was a broad rally across the indices. While technology stocks faced challenges throughout August, sectors such as financials, industrials, and healthcare ended the month on a positive note. Although Nvidia didn’t fully meet investor expectations, the broader market rose as investors shifted their focus from technology to other sectors.

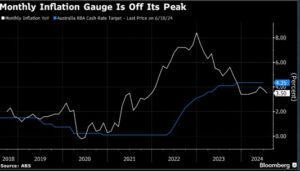

September is historically a challenging month for stocks, making it intriguing to observe if the market can sustain its upward momentum amidst growth concerns. During the annual Jackson Hole retreat, Federal Reserve Chairman Powell announced the commencement of a monetary easing cycle in September. With signs of weakness in the labour market, the focus has shifted to whether the Fed will implement a 25 basis points (bps) or a 50-bps rate cut. Personally, we anticipate a 25-bps cut to overnight cash rates. Unfortunately, Australians are unlikely to experience similar rate cuts in 2024. Recent figures show the year-over-year CPI at 3.5% and the trimmed mean at 3.8%, both well above the RBA’s target range of 2-3%. This persistent inflation suggests higher interest rates for a prolonged period. With quarterly growth rates expected to be weak at 0.2%, the RBA faces a challenging dilemma between managing sticky inflation and a sluggish economy. It’s a situation we warned investors about in our last newsletter, highlighting the likelihood of a stagflationary environment in Australia.

The U.S. election cycle is heating up, with polls indicating a tightening race between Harris and Trump. Although markets typically dislike uncertainty, they do favour gridlock in Washington, D.C. This could explain why the tightening race hasn’t significantly impacted equity markets, as it’s unlikely either party will control the Presidency, House, and Senate simultaneously. My lean is still towards a Trump victory, but the race has become closer since Biden withdrew.

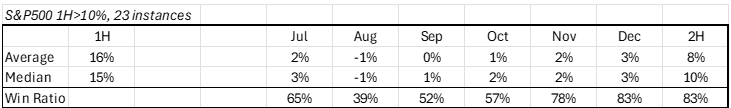

Looking ahead, we remain optimistic about American equities for the remainder of 2025, while I’m less bullish on Australian equities. Historically, when the S&P 500 has gained more than 10% in the first half of the year, it has finished up an average of 8% and a median of 10% in the second half, with an 83% chance of ending in positive territory. This trend suggests that the ASX may follow suit, albeit with continued underperformance. Expect August to October to be the most challenging months, with November and December likely to be the strongest. The table below summarises this historical performance.

There are numerous factors to be concerned about, including geopolitical events in the Middle East, U.S. elections, inflation, slowing labour markets, fiscal deficits, and high market multiples. However, history advises us to maintain a long position, especially post-election in early November.

Education Section

What is an ETF?

We have been using ETFs for many years now, and I thought that I would revisit the explanation as to what is an ETF, and why do we use them.

Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges, much like individual stocks. They are designed to track the performance of a specific index, commodity, currency, or a mix of assets, providing investors with a diversified portfolio in a single investment. One of the key advantages of ETFs is their liquidity, allowing investors to buy and sell shares throughout the trading day at market prices. Additionally, ETFs typically come with lower expense ratios and more transparency compared to managed funds, making them a cost-effective choice for many investors. With their ability to provide exposure to various asset classes and investment strategies, ETFs have gained popularity among both individual and institutional investors.

Types of ETFs

There are several types of ETFs available in the market, each with its own unique characteristics and investment strategies. Some common types of ETFs include:

- Equity ETFs: These track the performance of a specific stock market index, such as the S&P 500 or Dow Jones Industrial Average. They can also be focused on a particular sector, industry, or geography.

- Bond ETFs: These invest in fixed-income securities such as government bonds, corporate bonds, and municipal bonds. They provide investors with exposure to the bond market without having to purchase individual bonds.

- Commodity ETFs: These track the price movements of commodities like gold, oil, or agricultural products. They can provide diversification and a hedge against inflation.

- Currency ETFs: These track the performance of foreign currencies, providing investors with exposure to global currency markets and potential diversification from their home currency.

- Alternative ETFs: These include strategies such as inverse or leveraged ETFs, which aim to achieve returns that are opposite or magnified compared to the underlying assets they track. While these types of ETFs can offer potential for higher returns, they also come with greater risk and may not be suitable for all investors.

How to Invest in ETFs

Investing in ETFs is relatively straightforward and can be done through a brokerage account. Investors can choose between buying individual shares of ETFs or investing in a portfolio of ETFs. It is essential to do thorough research and carefully consider the investment objectives, risks, and fees associated with each ETF before making any investment decisions.

Conclusion

ETFs have become a popular investment choice for their ease of access, diversification benefits, and cost-effectiveness. With these benefits, ETFs are also a cost-efficient way to start investing for your children. With a variety of types available, investors can choose the right ETF to match their specific investment goals and risk tolerance. However, as with any investment, it is crucial to understand the potential risks and conduct proper due diligence before making any investments in ETFs. So please talk to us to see if using ETFs for your current portfolio is suitable, alternatively, if setting up an investment portfolio outside of super using ETFs is appropriate to your situation. Happy investing!

Stay Connected

Please follow us on LinkedIn and Facebook by clicking on the below links.

Please take the time to review us on Google by clicking on the link below –

Want to know more?

Thank you again for your trust in us and your loyalty, if you’d like to discuss any of the content in this update and how it may impact you, please call me on 07 3709 8485. If you know of anyone that you feel will benefit from meeting with us, please don’t hesitate to send them our details.