Welcome to the August update from Thesan Private Wealth. In this month’s update, we’ll review superannuation scorecards of some leading Industry superannuation funds, update you on the recent share market movements, and cover off what’s been happening in the property market.

Share Market Update

With barely a month into the new financial year, the market is seeing volatility in the form of a sell-off both domestically and internationally. It’s interesting to reflect on predictions made in our previous newsletter to provide some context as to where markets stands today.

“Prediction 3 – The market will trade off through September and October but end the calendar year higher.”

The market volatility began earlier than expected. Upon reflection I shouldn’t be surprised. Statistically, since 1950 when the S&P 500 is up more than 10% during the first half of the year (such as 2024), August is up only 39% of the time. We do expect the market to rally back in August, but it may head down again through September/October. I can’t stress this enough – investors should prepare themselves for market volatility until the latter part of October. If things continue as expected, we are expecting a Christmas gift for those willing to ride the volatility until the end of October.

So…. Why is the market selling off right now?

There are 5 reasons (in no particular order) –

- Seasonality – As stated above, August is a bad month when the S&P500 is up more than 10% in the first half. Irrespective of market returns in the 1st half, September is historically the worst month for the S&P 500. The market moves to the downside in anticipation of (generally) a bad September period.

- Election – We made a prediction that Trump would win the 2024 presidential election (Prediction 4) and we’re standing by it. The probability though has undoubtedly shrunk with the withdrawal of Biden from the race. This uncertainty has added to volatility as markets hate uncertainty. Harris is not Biden, and this means the Democrats are in with a chance that wasn’t there before.

- Labour market softens – The US labour market has softened with the all-important monthly employment numbers showing job losses and rising unemployment. The Sahm Rule – named after economist Claudia Sahm – says that the US economy indicates a recession has been triggered when the quarterly moving average of the unemployment rate rises by 0.5% relative to its low across the past 12 months. This was triggered on Friday with the 4.3% unemployment print. The Fed should (will) cut interest rates at their next meeting in September, but there may be some debate now on whether its 0.25% or 0.5%.

- Geopolitical tensions – Israel and Iran could very well be heading for war. With Iran signalling that retaliatory strikes will not be pre-announced it is conceivable that the Middle East conflict widens. Expect oil to spike if it does.

- Japan Carry Trade & Market Rotations – A popular institutional trade across international markets is to borrow money in a low interest rate environment (like Japan) and invest in higher rate countries like Australia and the US. With weakness in the Yen, the BOJ moved to increase rates in Japan which incentivised institutions to liquidate US and Australian positions and unwind leverage.

The strengthening yen has corresponded with falls in US/Australian share markets – see the chart below. Markets won’t find a bottom until the yen stops appreciating and markets come back into alignment. Adding to the pressure on stocks is a broadening of the market as money runs out of US technology and into other sectors such as Real Estate, Industrials and Financials.

Finally, with all the market turmoil it is reasonable to ask whether there is likely to be an RBA rate cut tomorrow. With inflation running hotter than other OECD countries and our interest rates already some of the lowest around, the answer is unfortunately ‘No’.

Superannuation Scorecard – The Results are in!

Industry super funds lose their competitive edge – and the problem may last for years to come.

The Impact of Asset Mix on Super Fund Performance

Superannuation investors have been witnessing a significant shift in the performance of their funds. For years, industry super funds had a lead over their commercial counterparts. However, recent performance results for the 12 months leading up to July indicate a major turnaround, with commercial retail super funds outperforming major industry funds often associated with large trade unions.

What Caused the Shift?

For those that currently invest with us, you would know that we value transparency highly. This is a topic that I’ve hammered home numerous times and felt that Industry super funds have a lot to answer for in this space, as the primary factor behind the shift with the industry funds’ performance lies in the asset mix of these funds. Industry super funds have historically invested heavily in “unlisted assets” such as toll roads, bridges, and properties. While these assets offered significant returns when interest rates were low, the recent rise in interest rates has turned this advantage into a disadvantage.

Missing the Share market Upswing

The heavy investment in unlisted assets meant that industry funds missed out on the robust sharemarket upswing, particularly in overseas markets. For instance, over the last 12 months, the U.S. sharemarket surged, driven largely by technology and healthcare stocks. This surge contributed to the U.S. now accounting for nearly 70% of the global market. Even without offshore contributions, the ASX performed relatively well, bolstered by key blue-chip stocks like Commonwealth Bank.

Performance Comparisons

The disparity is evident when comparing specific fund performances:

Fund | Investment Option | 2024 Financial Year |

AMP | Default Mysuper | 11.10% |

Australian Retirement Trust | Super Savings Balanced | 9.90% |

AustralianSuper | Balanced | 8.46% |

Aware Super | Super Balanced | 9.60% |

CBUS | Growth MySuper | 8.35% |

Colonial First State | FirstChoice Growth | 10.70% |

HESTA | Default MySuper | 9.10% |

Rest Super | Default MySuper | 8.67% |

Mine Super | Super Growth | 10.70% |

Mercer | Mercer Growth | 10.10% |

Brighter Super Balanced | Super Balanced | 10.60% |

Average Thesan Super investor return /Investment Account | Balanced/Growth* | 13-16% |

Average Thesan Super/Investment Account | High Growth* | 18-22% |

Average Thesan Super/Investment Account | International Equities* | 30+% |

Source: Super funds’ performance for year to June 30, 2024 & Chant West, July 2024

*Thesan does not use model portfolios as most portfolios are customised to the individual investor

Challenges for Industry Funds

The illiquidity of unlisted assets presents a significant challenge for industry funds. Fund managers cannot easily adjust their investment mix, making it difficult to capitalise on short-term market upswings. This issue, once touted as a unique selling point, has now become a legacy problem.

Mark Delaney, Chief Investment Officer at AustralianSuper, highlighted the struggle, stating, “If you weren’t in the U.S., you were just getting modest returns. Those investments exposed to higher interest rates really struggled… Even infrastructure didn’t do as well this year as last year.” He further noted that property was the worst-performing asset class due to revenue problems and the impact of higher interest rates.

Looking Ahead

For industry funds, turning the ship around will be a daunting task. The nature of unlisted, illiquid investments requires long holding periods, making it challenging to fully capture near-term market gains.

Conclusion

The recent performance shift underscores the crucial impact of asset allocation on fund performance. Investors should remain vigilant and consider how their fund’s asset allocation aligns with current and future market conditions, overlayed within their risk appetite. Understanding these dynamics will be key to making informed investment decisions and maximising returns.

Overall, the performance of super funds serves as a reminder that in the ever-changing landscape of investments, diversification and flexibility are critical to success. So, it is important for individuals to regularly review and assess their super fund’s asset mix to help ensure optimal performance and long-term financial stability.

What about the Property Market?

National Housing Market Trends & Forecasts

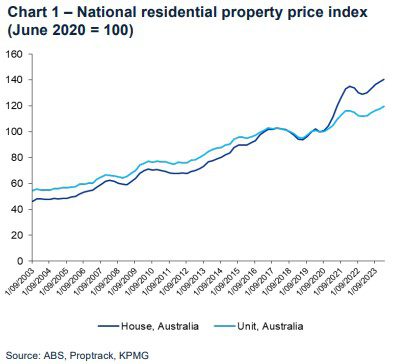

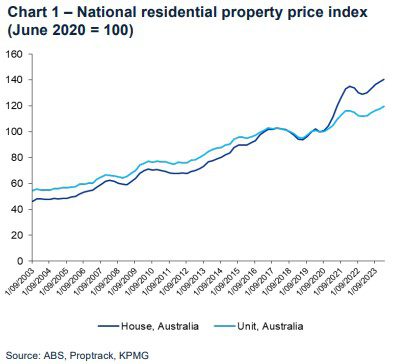

In a year marked by high interest rates, elevated inflation, and subdued consumer sentiment, national house prices increased by 7.7% and national unit prices rose by 6.1% between March 2023 and March 2024.

- Resilience Amid Mortgage Rate Increases – Households have shown resilience despite a 4-percentage point rise in mortgage rates and the fixed-rate mortgage cliff. This can be attributed to a robust labour market and a relatively low unemployment rate.

- Rising Rental Prices – Strong population growth and limited housing supply have heightened pressure on the rental market. Rental prices surged by 7.8% annually, marking the steepest rise since the March 2009 quarter. This growth reflects low vacancy rates and a tight rental market.

- Future Rent Growth Projections – Based on new dwelling completions and the Treasury’s population forecasts, anticipated annual rent growth is to be around 4–5% over the next two years.

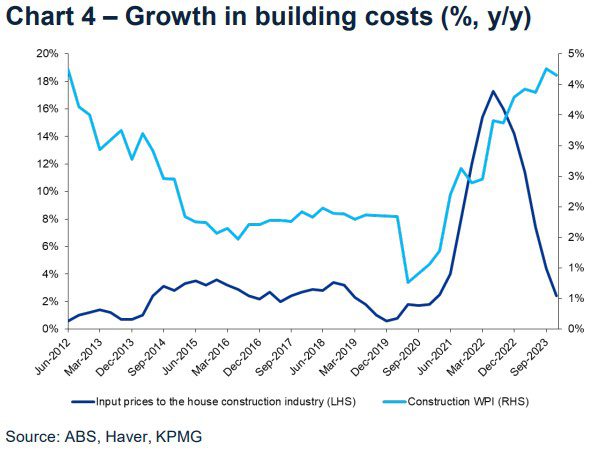

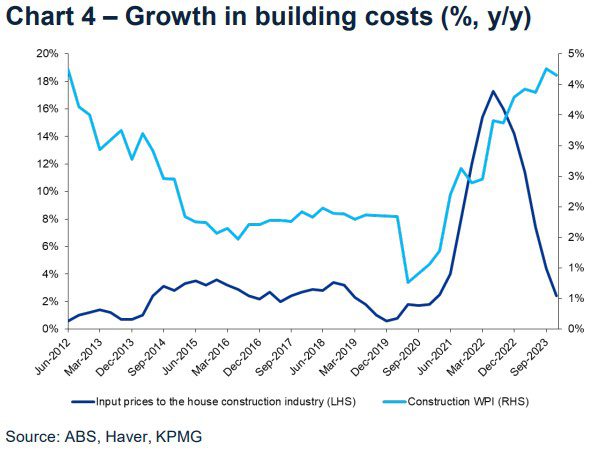

- Housing Approvals & Completions – Looking at the current trends, we foresee a reversal in the declining trend of housing approvals, fuelled by strong population growth and rising house prices. However, the time lag from approval to completion means that increased approvals will translate to actual housing completions at a slower pace within the forecasted period.

- Price Growth Outlook for 2024 – We expect price growth to decelerate in 2024 compared to 2023. The prolonged contractionary interest rates are likely to exert a cooling effect on the market, partially offsetting the gains seen previously.

- Influence of Interest Rates on 2025 Prices – Interest rates will be a crucial factor influencing house prices in 2025. With little anticipation that the Reserve Bank of Australia (RBA) will cut rates in the last quarter of 2024, credit availability will continue to impact house prices until this changes.

Conclusion

Unless you were in Melbourne, you would have seen relatively strong positive returns, this is despite cost-of-living impacts and interest rate uncertainty. We don’t see too many changes coming up for the property market, as any change will come off the back of inflation and employment data.

The latest July data reveals ongoing trends from the past year in the real estate market. While national prices continue their upward trajectory, the pace of growth has slowed. This deceleration is partly due to seasonal factors and affordability constraints, given that current prices are more than double what they were in 2011, the last time interest rates were at similar levels.

Outlook

Several factors will shape the market landscape in the coming months:

- Income Growth: Continued strong income growth, along with Stage 3 tax cuts, is boosting disposable incomes and borrowing capacities.

- Interest Rates: The Reserve Bank’s early August meeting could lead to further rate hikes, potentially curbing the price growth observed since early 2023.

- Spring Selling Season: Expect modest home price growth as the market moves into the traditional spring selling season.

Investors should closely monitor these evolving dynamics. The interplay of income growth, tax policies, and interest rates will be crucial in shaping market conditions, providing both opportunities and challenges for strategic investment decisions.

Stay Connected

Please follow us on LinkedIn and Facebook by clicking on the below links.

Please take the time to review us on Google by clicking on the link below –

On a personal note –

We are excited to announce that the Thesan family has grown, as Mathew and Sheena White welcomed their 2nd child ‘Gianna Yan White’ into the world on the 1st August. Mum and child are doing well but will see how Mat shapes up after a couple of weeks leave looking after his two little ones. If you need anything from Mat, please email admin@thesan.au and the team will respond on his behalf.

Want to know more?

Thank you again for your trust in us and your loyalty, if you’d like to discuss any of the content in this update and how it may impact you, please call me on 07 3709 8485. If you know of anyone that you feel will benefit from meeting with us, please don’t hesitate to send them our details.